All about Bad Credit Financing

Table of ContentsBad Credit Financing Things To Know Before You Get ThisNot known Details About Bad Credit Financing The 4-Minute Rule for Bad Credit FinancingWhat Does Bad Credit Financing Mean?The 5-Minute Rule for Bad Credit FinancingExamine This Report on Bad Credit FinancingBad Credit Financing - Truths

Debtors with bad debt may receive reduced rates of interest considering that they're installing security. If you back-pedal a safeguarded finance, your lender might legally take your collateral to recover the cash. And if your lending institution doesn't recover the price of the car loan by retrieving your assets, you may be in charge of the distinction.This technique can make it less complicated for customers with bad credit rating to be eligible for a funding, as it decreases the primary debtor's threat. If you're incapable to make payments on this sort of finance, not just can your lender effort to gather from you, they can additionally attempt to collect on the funding from your co-borrower.

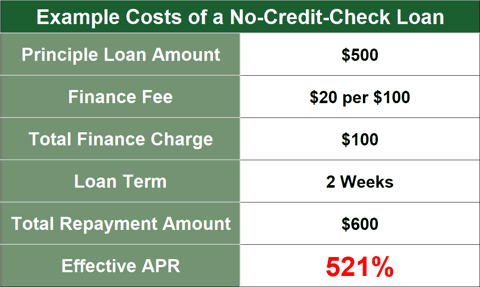

Cash advance financings are considered a more dubious sort of finance, with astoundingly high costs as well as rates of interest. These loans are normally much less than $500 as well as are anticipated to be paid back within two to four weeks. Lots of people who get payday advance typically have to get extra car loans to settle the initial payday advance loan, trapping them in a cycle of debt - bad credit financing.

Everything about Bad Credit Financing

Consumers that have excellent backgrounds with their bank. If you're in requirement of a temporary fix, you can utilize a currently positive relationship for economic support.

Like individual financings, with a house equity finance, you'll be given the cash in a swelling amount. Those that need large sums of cash as well as have equity in their residence Permits debtors to obtain approximately 80% of their home's value. Due to the fact that you're using your residence as collateral, skipping on your residence equity financing might result in losing your home.

Unlike house equity fundings, HELOCs commonly have variable rate of interest prices. Consumers that aren't sure how much money they want and needs to be able to obtain from their residence's equity over an amount of time Consumers can borrow and also pay back as required, and recycle the line of credit history. Considering that passion prices are variable, customers may experience extremely monthly payments.

Our Bad Credit Financing Diaries

While lots of lending institutions don't enable debtors to make use of a personal car loan towards education funding, loan providers like Upstart do permit it. Those that are going after funding for academic objectives Some student loan lending institutions will hide to the whole price of your tuition. Some loan providers have stringent or vague forbearance as well as deferment programs or none in any way in instance you're not able to settle the car loan down the road.

Represent all personal revenue, consisting of salary, part-time pay, retired life, financial investments as well as rental properties. You do not need to consist of spousal support, kid support, or different upkeep revenue unless you want it to have it considered as a basis for paying back a financing. Rise non-taxable earnings or benefits included by 25%.

The deals for monetary items you see on our system come from companies who pay us. The cash we make aids us give you accessibility to complimentary credit rating as well as records as well as helps us produce our various other fantastic tools as well as instructional materials. Settlement might factor right into just how and where items show up on our system (and in what order).

The Ultimate Guide To Bad Credit Financing

That's why we offer attributes like your Authorization Probabilities as well as savings estimates. Of training course, the offers on our platform don't stand for all economic products out there, yet our goal is to show you as learn this here now many excellent options as we can.

They come with expenses, consisting of source, late as well as not enough funds fees that may boost the quantity you have to repay.

The Ultimate Guide To Bad Credit Financing

Feasible offers the option to obtain up to $500 "instantly" and also pay back your financing in four installments. The loan provider says it generally pays out funds within just minutes yet that it might use up to five days. Possible isn't available in all states, so check if it's supplied where you live before you apply.

The app does not bill passion when you choose the pay-in-four option, and there are no fees if you pay on schedule. If your repayment is late, you may be billed a late cost of up to 25% of the order value. The amount you can invest with Afterpay varies based on numerous elements, consisting of how much time you have actually been an Afterpay user, how frequently you make use of the application, your app repayment background as well as more.

Not known Incorrect Statements About Bad Credit Financing

, finance a residence enhancement or take treatment of an emergency cost, a personal funding may assist. Below are some points to recognize if you're considering applying for a personal funding with negative credit.

Right here are a couple visit this site right here of fundamental terms to pay interest to. APR is the complete expense you pay annually to obtain the money, consisting of passion as well as certain costs. A lower APR suggests the funding will usually cost you much less. An individual financing for somebody with negative debt will likely have a higher APR.

Many personal lendings need you to make fixed month-to-month repayments for a set amount of time. The longer the payment period, the more passion you'll likely pay, and my sources also the more the finance is likely to cost you. Monthly settlements are largely established by the quantity you obtain, your passion rate as well as your lending term.

While qualifying for an individual car loan can be difficult and also pricey for somebody with negative credit scores, borrowing may make sense in certain situations.